The Toronto tax rates are complicated and non-linear, which can make tax planning difficult. The Toronto tax rates are also a first step in the tax planning process. Toronto is a city where personal property taxes are a big part of the tax rate. This article will help you make sense of the Toronto tax rates.

Tax rates in Toronto

The Toronto tax rates are complicated, and there are many different tax rates that you need to know about. The taxes that are imposed in Toronto are broken down into three categories: personal, corporate, and property. The Toronto tax rates that are imposed on personal income are the highest in Canada. The Toronto tax rates that are imposed on corporate income are the highest in North America. The Toronto tax rates that are imposed on property are the highest in North America. Toronto has a high rate of taxes on property because there is a high demand for Toronto real estate.

Tax Rates on Personal Property

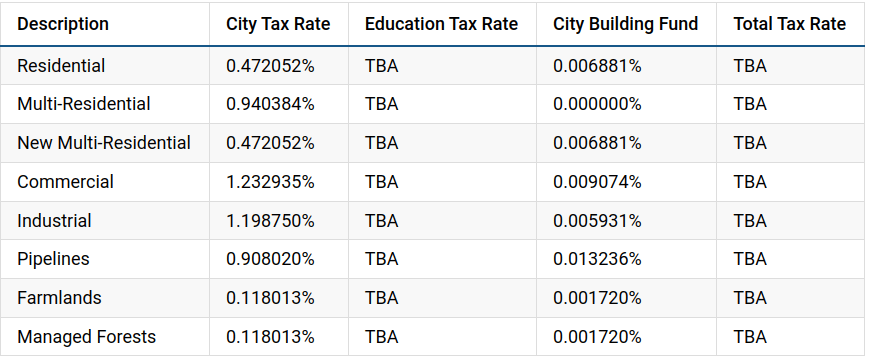

The tax rate on personal property is the rate applied to the value of personal property, including tangible personal property and real property. The tax rate on personal property is set by the Toronto Municipal Code. The tax rates for 2022 are as follows:

Tax Rates for Personal Property:

The Tax Rate on Business Income

As a business owner, you cannot avoid paying taxes. There are many different types of taxes that you have to pay, and they vary depending on the type of business you own. The tax rates for business income is one of the more complicated taxes that you have to pay, as it has different tax brackets depending on the type of business you own. The following is a guide to the complications of the Toronto tax rates. The Basic tax rate for larger businesses in Ontario is 11.5%.

Small businesses can use the Ontario small business deduction which helps reduce their basic income tax rate of around .3%.

If the rate changes during the tax year, you have to base your calculation on the number of days in the year that each rate is in effect.

Conclusion

In Toronto, there are three tax rates: residential, commercial, and industrial. The residential tax rate is the lowest tax rate and is for people who live in the city. The residential tax rate is 0.4%. The commercial tax rate is .6% and the industrial tax rate is .9%. This means that the residential tax rate is four times lower than the commercial tax rate and nine times lower than the industrial tax rate.